When I travel, I have the habit of going to local marts or supermarkets to see what kind of brands are on the shelves. I usually end up buying a bunch of local brands, in which tea or coffee sachets are the safest choices. They have a long shelf life and are easier to bring along. And it’s happier when I open my cupboard and see small indulgences from different countries [useful life hack when budget travel runs low].

This week, I found out that one of my tea stocks, Luk Yu, was nearly out of stock. I decided to write about this brand in case I forget it in the future.

So, what is this product?

- Luk Yu tea bags are a line of tea products that include various types of tea, notably Pu-erh, which is known for its rich flavor and health benefits. These tea bags have been a staple in Hong Kong for more than 40 years. 40% of Luk Yu’s retail customers are office workers aged 28 to 38.

- The name “Luk Yu” is derived from the Tang dynasty poet Lu Yu, who is famous for his work The Classic of Tea, which discusses the culture and history of tea in China. This connection to tea heritage adds a layer of authenticity to the brand.

What makes Luk Yu a staple in Hong Kong for more than 40 years?

- Historical Roots: The Luk Yu brand is closely associated with the Luk Yu Tea House, which has been a prominent establishment in Hong Kong since 1933. The legacy of the tea house contributes to the brand’s recognition and trustworthiness among consumers in Hong Kong.

- Product Quality: Luk Yu tea bags are known for their quality, using carefully selected teas blended to achieve a balanced flavor profile. Tea is sourced from China, mostly Yunnan and Fujian. The brand emphasizes quality, using top-grade filter paper and a larger quantity of tea than typical bags to provide a quality infusion experience and ensure freshness.

How big is the tea market in Hong Kong, Luk Yu’s homeland?

- The revenue of tea at home in the Tea market amounts to US$220 M in Hong Kong. If including revenue of out-of-home consumption (restaurants, bars), the combined revenue will be US$ 710M (Statista)

- Terry, a friend who is living in Hong Kong shared that Luk Yu is one of the most popular tea bag brands in offices, along with Lipton (thanks mate!).

Being a private company, so financial numbers are not publicly available. Since it’s a staple brand, its revenue mix will derive from both (1) retail customers and business/corporate sales, (2) domestic and export sales. The brand sells to China, Canada, UK, EU, Australia, New Zealand, Singapore, Czech.

I made a quick calculation to estimate annual domestic revenue of Luk Yu, based on the information available

Retail price listed on PARKnSHOP – Hong Kong’s leading O+O supermarket chain).

Of course, this is a guesstimation, and we can always play with assumptions such as % retail vs corporate sales to evaluate revenue. What the estimation is missing is (1) % export sales, (2) increase in daily production capacity, so actual revenue could be higher than this guesstimation. Another thing that did not sit right with me on this estimation is that at annual revenue of $7.3M in a market size of $220M (at-home), which implied a market share of 3.3%, while Luk Yu advertised on its website that the brand captured 60%+ of market shares in Hong Kong 🤔.

Next step, so at a top-line revenue of around (minimum) US$ 7.3M per year, with multiples of EV/Sales in the range of 1.4x [ref data point of a comparable: Pu’er Lancang Ancient Tea Co., Ltd. (6911.HK)], that translate to an enterprise valuation (‘EV’) of US$ 10.2M.

Alternatively, using EV/EBITDA multiples of 4.46x with a 5-year average EBITDA margin of 33% (both are referenced from Lancang), the implied EV of Luk Yu will be about US$ 10.8M.

hmmm, what could go wrong here? The estimated valuation does not take into account the intangible value of the brand (‘a staple product for more than 40 years’), so there will be high chances of debatable premiums charged to the EV in the end to reflect its market value.

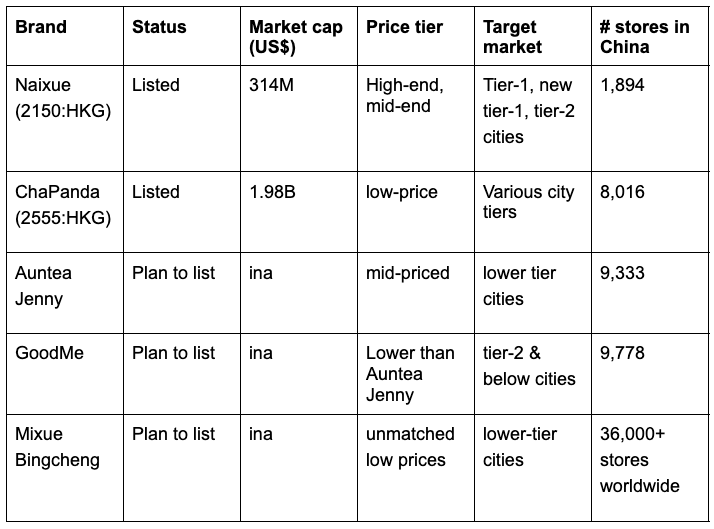

[fun irrelevant fact: HKEX is a popular choice for Chinese tea chain brands to list:

Who owns this 40-year legacy brand with a loyal customer base that makes around 7-10M per year?

- Founded by Michael Wong with a clear vision: to make Chinese tea more accessible and easier to enjoy, like the way English tea is consumed. As lifestyles changed and the pace of life quickened, he recognized that tea bags would become a preferred option for many consumers. Fact: Wong worked at Lipton during his early days (&then)

- In the early days, Wong faced significant challenges in gaining customer interest. To overcome this, he employed free tasting sessions and promotions like “buy tea bags and get free cakes”. Sales eventually got picked up along with the increase of the pace of life and the convenience (of tea bags) became a trend.

- Wong’s dedication to quality is evident in his sourcing practices. He imports filter paper from Europe and carefully selects teas from various gardens each season. This commitment ensures that Luk Yu’s products maintain high standards, which has helped build a loyal customer base.

What were the things that Wong said No to during the development of Luk Yu?

- the opportunity of selling bottled tea because Wong wanted to keep natural ingredients free from sugar or preservatives. If they pursue bottled tea, the proportion of sales to young people <28 yo can be 20-30% [currently at 10% total revenue] (HK01).

- the opportunity to set up factories in northern China like what other Hong Kong manufacturers did in the early 1980s. Moving factories to China could decrease costs by 50%, hence higher profit. Wong chose to keep factories in Hong Kong because he wanted to keep Luk Yu “Made in Hong Kong.” During the Covid-19 pandemic, the supply chain of Luk Yu was not severely impacted like that of other tea manufacturers who relied on Chinese factories.

What are the changes that Michael’s successor, Wang Tingsui (Wong’s son, an UK educated folk), do differently than his father?

- He made changes slowly and carefully. For example, the changes in packaging were made little by little with the color. If they change immediately, customers may not accept it.

- Opened a new product line of cold brew bottled tea (both single-use and multiple-use with BPA-free bottles). He plans to work with U.S. drug manufacturers to develop new tea products for health purposes, such as for women’s menopause. This will help Luk Yu to reposition the brand and expand customer profiles for continued growth.

disclaimer: the post is for non-profit purposes only. Views are my own, not investment advice, and no responsibility is attached.

Leave a comment